CRM for an insurance company

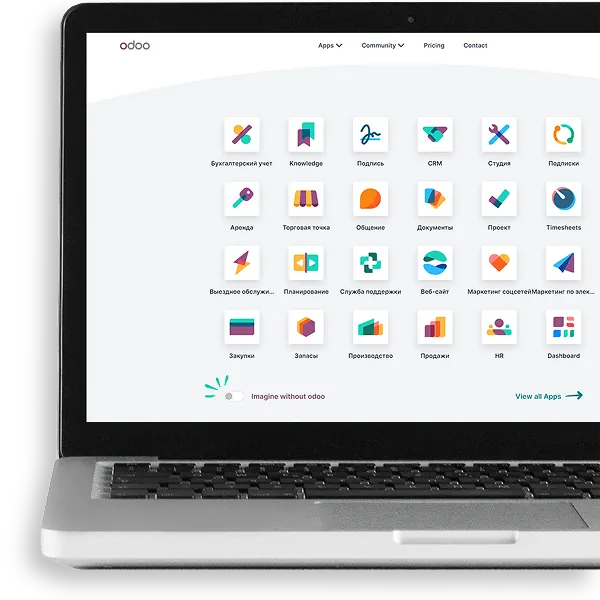

High competition in the insurance industry requires companies to quickly adapt to the realities. Anyone who combines speed of response and unmistakable legal accuracy is able to attract more customers and scale their business. It's hard to imagine this without digital tools, so automation is a handy tool. Odoo CRM for an insurance company improves customer focus by ensuring prompt communication.

Odoo CRM features for an insurance company

The software is developed based on the needs of the insurance agency. Odoo CRM is complemented by such features as:

- Customer base and omnichannel communications. The program allows you to create unified customer cards with a history of interactions, as well as integrate telephony, e-mail, instant messengers, and a website for a continuous dialog.

- Document management and legal and financial integrations. You can create, extend, and cancel contracts and policies, as well as templates, and connect with banking, accounting, and ERP services.

- Accounting for insurance claims and SLA control. The insurance agent can register claims and attach photos/documents.

- Distribute applications and manage the funnel. Automatic routing of leads and cases, statuses, and reminders.

- Analytics and basic reports. Daily reports on applications, sales, and employee productivity are available.

- Internal collaboration and knowledge base. Employees can see comments in cards, instructions, video tutorials, and standards.

- Partners, brokers and multi-office. Users have access to commission accounting, contract control, and overdue notifications.

- AI capabilities and support bots. Automatic calculation of premiums, prioritization of applications, risk assessment based on historical data.

Implementation of the Odoo CRM system allows you to speed up the processing of insurance claims and reduce the number of overdue transactions through automatic routing and reminders. Automation provides a transparent audit of contracts and financial transactions, and reduces manual errors in calculating commissions and premiums.

Benefits of implementing a CRM system for an insurance company

CRM for an insurance agent is a tool that reduces the time from FNOL to settlement through automatic case routing and disciplines sales by controlling the stages of the transaction. The program also has the following advantages:

Supporting clients with contract renewals. Automatically sends reminders about the expiration of policies, which helps to avoid loss of income and ensures timely renewal of insurance contracts.

Prompt distribution of insurance claims. It allows you to quickly transfer new requests and complaints to the appropriate specialists, reducing the time for their consideration and increasing customer satisfaction.

A single platform for communications. All communication channels are unified in one system, which ensures convenient communication for customers and transparency for the company.

Automation of sales processes. The program allows you to assign tasks and distribute contracts between agents, which guarantees compliance with service standards.

Improving staff qualifications. Odoo CRM helps to identify the strengths and weaknesses of employees, which allows you to create individualized training programs and increase the efficiency of the sales team.

Analytics and decision-making. Detailed reports provide a complete picture of the company's activities, allowing management to make strategic decisions based on verified data.

A CRM system for an insurance company allows you to create transparent processes, build long-term relationships with customers, and quickly respond to any market changes. The use of software increases the agency's competitiveness and builds trust in it.

Why should an insurance company implement a CRM system?

CRM helps to improve the quality of service and transparency of financial transactions. Using modern solutions, insurance companies:

- optimize processes;

- adjust price offers without inflated commissions;

- reduce customer costs;

- maintain profitability.

Thanks to CRM, insurance becomes more predictable and efficient: standardized templates reduce payment errors, and integration with payment and banking services speeds up financial transactions. Odoo CRM allows you to personalize rates based on customer history and behavioral analytics, quickly adjust offers to the risk profile, and reduce churn through targeted policy renewal campaigns. This turns chaotic operations into well-established processes, increasing the speed of service, reducing operating costs, and strengthening the company's financial stability.